Innovation and venture-building are powerful complements, blending corporate stability with startup agility to drive meaningful growth and adaptability. This week, we’ll examine how collaboration between corporations and startups creates mutually beneficial relationships: corporations gain entrepreneurial speed and disruptive insights, while startups leverage resources, scale, and networks.

By adopting shared methodologies like lean experimentation and customer validation, both entities can align on innovation goals. Ultimately, this synergy enables organizations to navigate disruption, explore new markets, and remain competitive in an era of constant change.

In this week’s edition, we'll explore the opportunities for startups and corporations to collaborate and learn from one another.

Here’s what you’ll find:

This Week’s Article: Innovation and Venture-Building Go Hand-in-Hand

Case Study: The Rise of Venture Studios

3 Must Reads: Coming Thursday!

Innovation and Venture-Building Go Hand-in-Hand

Introduction: Innovation ≠ Disruption

Innovation and disruption are not synonymous, but they can and should coexist. In a corporate environment, innovation is often focused on enhancing efficiencies or creating new products within existing frameworks—we call these Sustaining Innovations. Startups, on the other hand, embody disruption by rewriting the rules, often upending entire industries. We call these (not surprisingly) Disruptive Innovations.

Together, corporations and startups can form a symbiotic relationship, leveraging their respective strengths for mutual benefit. And this relationship isn’t just possible—it’s essential to the growth and development of new technologies, business models, and value for both companies and customers.

As history has demonstrated time-and-again, large firms struggle to align disruptive innovation within their behemoth structures. Contrary to popular belief, this isn’t because of bad management or a complete lack of vision, but rather is most often attributable to the market dynamics necessary to drive growth at massive scale.

Startups, on the other hand, lack the evolved distribution mechanisms necessary to exploit their innovations fully in the market. I’d highly recommend giving Philip Thomas’ musings on the subject a quick read.

By combining forces, these two entities can bridge gaps that would otherwise stifle innovation or prevent scalability.

Corporate Organizations and Startups: A Perfect Match?

Why Startups Need Corporations

Startups thrive on agility, creativity, and speed, but often face barriers when scaling. Issues like capital constraints, limited access to distribution channels, and operational infrastructure hinder their growth. Corporate partnerships can help startups navigate these challenges by providing resources, mentorship, and strategic guidance.

Why Corporations Need Startups

Corporations, on the other hand, can become bogged down by bureaucracy and risk aversion, slowing their ability to innovate. Partnering with startups offers corporations a pathway into disruptive methodologies—lean experiments, rapid prototyping, and customer validation—which are key mechanisms for fostering innovation.

Over the last ~15 years, we’ve seen an increase in the number of corporations adopting a venture-building mindset as a means to remain relevant in our age of rapid disruption. By building corporate venture funds to invest outside startups, building internal startup incubators, or creating internal startup factories (venture studios—more on this below), corporations can leverage entrepreneurial energy without overhauling their entire organizational structure.

The lean startup approach, widely adopted in entrepreneurial circles, can also guide corporate innovation. Its principles—continuous feedback loops, minimum viable products (MVPs), and iterative learning—are every bit as important for large enterprises as they are to the startups that have championed these methods for years. Corporations can learn to innovate more nimbly, while startups can scale responsibly.

For example:

Customer Development: Both startups and corporations need to “get out of the building” to validate customer needs. This is as true for startups with new ideas as it is for corporations seeking to launch new products.

Rapid Prototyping: Techniques like the “sprint” methodology can accelerate decision-making and execution in both contexts.

Experimentation Through Lean Methodology: Both startups and corporations can benefit from structured experimentation. Startups often use the “Build-Measure-Learn” cycle to iterate quickly on their ideas. Corporations can adopt similar lean experimentation practices to test new product concepts or business models in low-risk environments.

Commercial break...

This edition of Innovate, Disrupt, or Die is brought to you by Apollo 21.

We partner with companies ranging from startups to Fortune 100's like Bank of America, artists like Ray LaMontagne, and pro sports teams like the Austin Gamblers, to envision their future and dream up new products, websites, apps, and AI capabilities. And we bring them to life.

Request a free brainstorm with us today.

Challenges and Solutions

While the collaboration between corporations and startups holds immense promise, it is not without challenges:

Culture Clashes

Corporations and startups inherently approach work differently. Corporations often prioritize stability, scalability, and risk management, operating on longer timelines with well-established procedures. Startups, by contrast, thrive on agility, creativity, and risk-taking, often embracing a “fail fast” mentality to innovate rapidly. These opposing mindsets can lead to friction when trying to collaborate.

To bridge this divide, corporations can create dedicated innovation teams or spin-off ventures that operate independently from the larger organization. These teams are insulated from the bureaucracy of the core business and can adopt startup-like methodologies, such as lean experimentation or rapid prototyping.

For example, companies like Alphabet use spin-offs like X (formerly Google X) to explore moonshot ideas without interfering with their core operations. These entities can experiment freely, then funnel successful innovations back into the corporation for scaling.

Resource Allocation & Budgeting

Corporations generally focus on highly procedural decision-making about where to allocate their resources. Balancing investments in core businesses that drive current profitability and new ventures that promise future growth is a constant challenge. Similarly, startups may struggle to secure adequate funding or access to critical resources necessary to outpace their corporate peers.

Adopting flexible budgeting models allows organizations to allocate resources dynamically based on venture milestones and performance metrics. Instead of committing large sums upfront, corporations can use a stage-gate approach, releasing resources incrementally as ventures meet key benchmarks like customer validation and product/market fit. (We talked about this in detail in part 4 of our series on metrics that crush innovation.)

For example, 3M’s innovation strategy dedicates 15% of employee time to independent, exploratory projects while maintaining robust funding streams for its primary businesses. Additionally, corporations can establish venture funds or corporate accelerators to ensure startups have access to the financial and operational resources they need without diverting resources from core operations.

Strategic Alignment

Another challenge worth addressing is ensuring that corporate and startup goals are aligned. Misaligned expectations about outcomes, timelines, or objectives can derail even the most promising partnerships. This is particularly dangerous when we consider the differences in operating styles between startups and large orgs. It’s easy for everyone to feel aligned amidst the excitement of a new collaboration, but that excitement can be tempered quickly by the realization that familiar processes can be functionally different in these unique environments.

To avoid these issues, startups and corporations should endeavor to develop clear partnership frameworks with defined roles, responsibilities, and success metrics. Regular communication and joint planning sessions can keep both parties aligned. For example, Unilever’s Foundry accelerator works with startups to co-develop solutions tailored to specific business needs, ensuring mutual benefit.

Conclusion

Innovation and venture-building are not competing strategies but rather are complementary. When corporations and startups collaborate effectively, they can amplify each other’s strengths. These partnerships allow corporations to remain relevant in rapidly changing markets and helps startups overcome the barriers to growth and distribution.

The Rise of Venture Studios

Venture studios represent a unique convergence of corporate stability and startup agility. These entities, also known as startup factories or venture builders, are structured to ideate, incubate, and scale new ventures in a streamlined, systematic way. By blending the entrepreneurial speed and experimentation of startups with the resources and scale of corporations, venture studios have emerged as a powerful engine for innovation.

What is a Venture Studio?

A venture studio is an organization that builds startups from the ground up, typically by:

Generating and validating ideas internally.

Allocating resources—capital, talent, and infrastructure—to launch ventures.

Scaling these ventures rapidly through expert guidance and established networks.

Unlike accelerators or incubators, which support external startups, venture studios take an active role in founding and operating the startups they create. These startups benefit from a pre-designed roadmap, access to studio expertise, and a share of the studio’s operational resources.

Why Are Venture Studios Effective?

Rapid Ideation and Validation: Studios use frameworks like lean startup and design thinking to test business ideas quickly and cost-effectively .

Reduced Risk: Corporate-backed venture studios leverage extensive market knowledge and resources to mitigate risks for their startups. Corporations can guide ventures through legal, regulatory, and operational challenges.

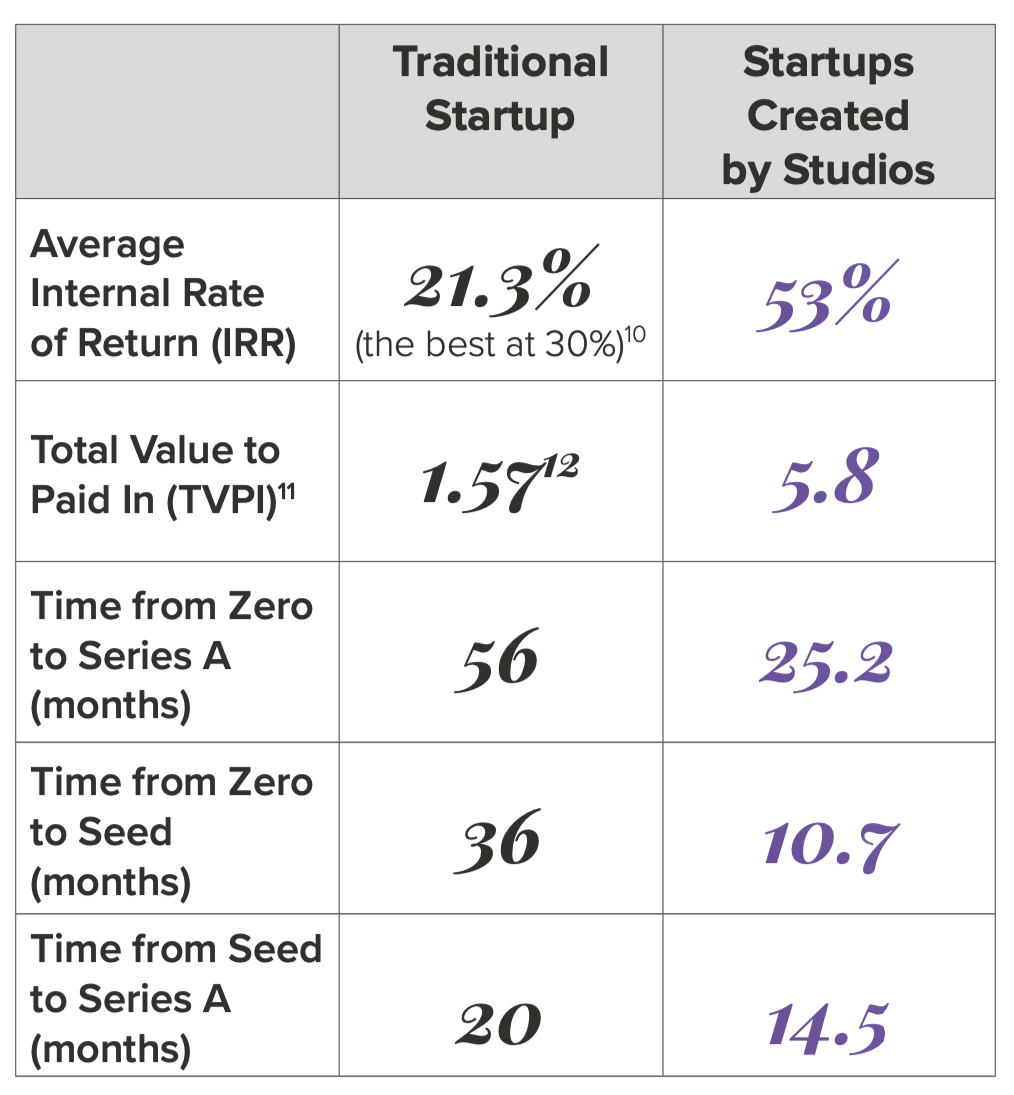

Accelerated Funding and Exits: Research shows that startups launched in venture studios secure seed funding twice as fast and achieve exits 33% faster than conventional startups . This efficiency stems from the studio’s ability to connect startups with pre-vetted investors and markets.

Historically, venture studios have outperformed traditional startups by a substantial margin:

We’re trying something a little different this week. Keep an eye out for 3 Must Reads, coming this Thursday.

Enjoying Innovate, Disrupt, or Die?

Refer 3 friends and we’ll send you a copy of our exclusive e-book, Beyond Buzzwords: Driving Tangible and Repeatable Innovation in Business.

All you have to do is share your link:

{{ rp_refer_url }}